In terms of navigating the advanced planet of insurance plan, locating the right Insurance policy Alternatives can really feel like trying to remedy a puzzle. But don't worry, you are not by yourself in this! Insurance coverage methods are created to shield you, your family and friends, plus your belongings from surprising risks and economic burdens. Comprehension how they operate may help you make educated choices that can help you save loads of pressure and dollars in the long run. So, Enable’s dive into what insurance policy solutions are all about, why they make any difference, and how to select the finest 1 for your needs.

At the heart of insurance policies alternatives is the concept of security. Picture a security Web that catches you when lifetime throws you a curveball—whether or not that’s an automobile accident, a health unexpected emergency, or a home disaster. Coverage functions equally. You shell out a premium, As well as in return, your insurance plan supplier promises to protect certain financial losses in the function of a catastrophe. These options can vary from fundamental protection to extra specialised programs, based upon That which you're hoping to safeguard.

When you think about insurance policy, you may think health programs or car insurance coverage, but there’s an entire universe of possibilities on the market. Residence insurance plan, life insurance, incapacity insurance, and more—each is a unique solution tailor-made to handle certain hazards. By way of example, everyday living insurance plan is a superb option for guaranteeing your family’s economical protection in the party of the passing. On the flip side, home coverage assists safeguard your assets and belongings from harm owing to fireplace, theft, or pure disasters.

Rumored Buzz on Risk Reduction Insurance Solutions

Picking out the proper insurance policy Remedy is dependent closely on your own conditions. Have you been a youthful Expert just beginning? Or perhaps you do have a spouse and children and a property finance loan to worry about? These elements Enjoy A serious role in deciding which kind of coverage you need. In case you are one And do not very own a house, a standard health insurance coverage system could be enough for now. But Should you have dependents, you might need to have extra thorough lifetime and health protection to protect All your family members's future.

Picking out the proper insurance policy Remedy is dependent closely on your own conditions. Have you been a youthful Expert just beginning? Or perhaps you do have a spouse and children and a property finance loan to worry about? These elements Enjoy A serious role in deciding which kind of coverage you need. In case you are one And do not very own a house, a standard health insurance coverage system could be enough for now. But Should you have dependents, you might need to have extra thorough lifetime and health protection to protect All your family members's future.It is easy to have overcome with all the jargon and diverse plan selections available. But don’t Permit that scare you absent. Think about insurance policy as being a Instrument to manage risk and safeguard your long term. The key is comprehension what dangers you are subjected to and what you want to safeguard. For example, in the event you travel routinely, vehicle insurance policies can be a no-brainer. Should you personal beneficial property, property coverage could help you save through the financial fallout of disasters.

Just one essential issue to look at when evaluating insurance plan answers is your finances. Different policies come with distinct value tags, and It is important to find a stability in between suitable protection and affordability. You don’t have to interrupt the bank to protected very good defense, but You furthermore may don’t choose to skimp on coverage just to save lots of a couple of bucks. Think about insurance being an expense within your comfort—it’s about making certain you are not financially exposed when lifetime throws an sudden problem your way.

A further component to bear in mind could be the insurance company’s name and reliability. It’s not ample to only select any insurance provider. You need to do your study and discover a company that’s trusted and known for excellent customer service. All things considered, what’s the point of having insurance plan if the company gained’t spend out after you have to have them most? Try to look for insurers which have powerful assessments as well as a background of supplying reliable, prompt promises managing.

Customization is An important gain In relation to modern-day insurance policy solutions. Numerous insurers allow you to tailor your coverage to fit your specific requirements. This can consist of altering protection restrictions, adding riders, or bundling differing kinds of insurance coverage (like household and vehicle) for excess price savings. If you have particular desires, for example insuring a uncommon collection or supplying for your Specific-requirements dependent, you could normally find a coverage that matches These needs precisely.

Not known Incorrect Statements About Insurance Claims Solutions

A lesser-recognized element of insurance plan solutions would be the function of deductibles. This is the total It's important to pay out out-of-pocket prior to your insurance coverage kicks in. The next deductible usually lowers your high quality, but it also suggests you'll be within the hook For additional of The prices if a thing goes Completely wrong. It is a trade-off concerning saving money upfront and getting organized for probable expenses down the line. Weighing your options carefully can make sure that your deductible is in keeping with your economical condition and hazard tolerance.It’s also necessary to think about the lengthy-time period When picking insurance coverage answers. Lifetime changes—Professions evolve, households grow, residences get bought, and overall health wants shift. Your insurance policy needs will probable change with Click for info it. That’s why it’s crucial that you evaluate your insurance policies periodically and make adjustments as required. As an example, for those who’ve recently experienced a newborn, you might like to update your life insurance policies coverage to mirror the new loved one. Or, for those who’ve paid out off your automobile bank loan, you may want to reassess your automobile insurance coverage.

If you’re a company owner, the entire world of insurance policies could possibly get all the more complicated. Business insurance plan remedies are meant to secure your company from several different threats, such as residence injury, liability, personnel injuries, plus much more. Think of it to be a protect that retains your small business Secure from unanticipated economical setbacks. From tiny corporations to huge enterprises, locating the right insurance coverage coverage can mean the difference between retaining your doors open up or dealing with economic spoil.

Together with personalized and business enterprise insurance policy, there are also specialised remedies like pet insurance policy, travel insurance policy, and incapacity insurance policies. Pet insurance policies can assist you address veterinary expenditures in the event of sickness or harm, when journey insurance coverage can provide protection for excursion cancellations, missing luggage, and professional medical emergencies though overseas. Incapacity insurance coverage is an important selection when you depend upon your capability to operate and need to safeguard your earnings in the event of a collision or illness that leaves you unable to earn a dwelling.

The entire process of implementing for insurance alternatives happens to be less complicated over time. Many insurance policies providers now provide on-line equipment that permit you to Evaluate rates, personalize guidelines, and also order protection in only a few clicks. This comfort will save time and helps make the method far more available to the common buyer. Explore here Nonetheless, it’s nevertheless crucial that you study the great print and fully grasp what your policy handles, this means you’re not caught off guard any time you need it most.

In relation to promises, insurance plan businesses usually Use a procedure that helps make sure all the things is dealt with efficiently. Nevertheless, this will vary depending on the insurer. Some firms are noted for their quickly and economical promises processes, while others might have a far more complicated or time-consuming method. Should you’re worried about how your promises might be handled, it’s value examining critiques or asking for recommendations from current or past consumers.

Occasionally, coverage options can also be used as a Instrument for saving. Certain insurance policies, like lifetime insurance plan which has a funds price component, can accumulate a money value after a while. Which means that As well as presenting a Dying advantage, your coverage could also act as a kind of financial savings or expenditure. If This is often a thing that passions you, it’s essential to understand how the money value is effective and whether it aligns with your prolonged-phrase monetary aims.

Yet another thought when Discovering coverage options is the influence of deductibles and rates on your own working day-to-working day funds. A reduced top quality may feel attractive, but it really could feature a higher deductible, which may not be best if you need quick guidance. It is really necessary to estimate Everything you can afford within the function of an emergency, and what suits easily into your month to month budget. Insurance plan is just not meant to get a monetary stress but fairly a lifeline when you will need it most.

Insurance coverage answers also Participate in a important job in serving to organizations mitigate threat. As an example, if you operate a firm that discounts with the general public, legal responsibility insurance policy can guard you from lawsuits associated with accidents or mishaps that take place on your Explore more premises. Similarly, house insurance policies can help you Get better if your small business suffers harm due to a fireplace, flood, or other surprising activities. By possessing the best insurance protection set up, you develop a safety Internet that permits you to focus on developing your organization in lieu of worrying with regards to the "what-ifs."

Insurance Benefits Solutions Can Be Fun For Everyone

Ultimately, insurance policy alternatives are about peace of mind. They're not almost preventing economic loss—they’re about experience assured and safe while in the deal with of daily life’s uncertainties. Whether or not you happen to be buying a new house, setting up a relatives, or creating a small business, insurance allows be sure that you are not still left uncovered when items go Completely wrong. By Discovering your options and obtaining the appropriate coverage Alternative on your unique wants, you’ll be able to face the long run with self-confidence, figuring out you’ve received the ideal safety in position.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Jenna Jameson Then & Now!

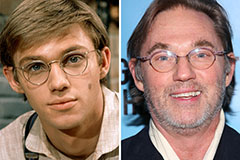

Jenna Jameson Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!