Lifestyle insurance coverage is something which many of us usually put off considering, normally because we hope it’s anything we gained’t have to have for some time. But the reality is, everyday living is unpredictable, and securing a lifetime insurance policies coverage now can provide peace of mind for both you and your loved ones. So, what exactly is everyday living insurance plan, and why really should you think about getting it? Let’s break it down.

At its core, daily life insurance policies is usually a agreement amongst you and an insurance company. You shell out frequent rates, As well as in exchange, the company guarantees to deliver a lump sum of cash on your beneficiaries once you pass away. This payout can assist include funeral bills, debts, as well as offer ongoing financial aid for your family and friends. The beauty of lifestyle insurance policy is it may convey a way of stability throughout one of existence’s most hard times.

You'll find differing types of existence coverage, and knowledge the options available to you will help you make the best choice. The two main categories are time period existence insurance plan and whole life insurance coverage. Time period lifetime is simple—it offers coverage for a selected interval, for instance 10, twenty, or thirty a long time. For those who go away in that expression, your beneficiaries acquire the payout. For those who outlive the term, however, the protection finishes.

Alternatively, total everyday living insurance is long lasting. It lasts for the entire life time, and provided that you keep on paying out premiums, your beneficiaries are certain a payout. Additionally, whole life insurance plan frequently comes along with an investment element, making it possible for the policy to accumulate income worth over time. This may function a further asset, which you'll borrow versus or perhaps withdraw in sure instances.

The Best Guide To Insurance Fraud Solutions

When considering existence insurance plan, it’s important to think about your distinct demands. For example, in the event you’re young and balanced, expression daily life coverage could possibly be a far more affordable solution. You may constantly transform it to entire lifestyle afterwards In case your situation transform. On the other hand, In order for you lifelong protection and also the possible for creating dollars benefit, complete existence could possibly be the higher in shape. The important thing is assessing your own scenario and what will provide essentially the most reward for Your loved ones.

When considering existence insurance plan, it’s important to think about your distinct demands. For example, in the event you’re young and balanced, expression daily life coverage could possibly be a far more affordable solution. You may constantly transform it to entire lifestyle afterwards In case your situation transform. On the other hand, In order for you lifelong protection and also the possible for creating dollars benefit, complete existence could possibly be the higher in shape. The important thing is assessing your own scenario and what will provide essentially the most reward for Your loved ones.Another component to take into account is simply how much protection you would like. The correct quantity of protection will depend on your specific situation, for instance your debts, All your family members’s economic needs, plus your upcoming options. A standard guideline is to have ample coverage to exchange your profits for quite a few a long time, but All and sundry’s circumstance is exclusive. That’s why speaking with an insurance agent who may help you work out the proper level of protection is a great strategy.

A lot of people select life insurance policies to protect their loved ones. One example is, in case you’re the first breadwinner in your family, existence insurance plan can substitute your earnings if a little something takes place for you. This makes certain that your partner or little ones gained’t be still left struggling financially. Even if you don’t have young children, daily life insurance can continue to be beneficial in covering debts, funeral charges, together with other costs That may if not fall on your family and friends.

But life insurance policy isn’t just for people with family members. It can be a sensible financial Resource for anybody, Even when you’re one or don’t have dependents. When you have important debts, for example college student financial loans, mortgages, or charge card balances, existence insurance policy can avoid People debts from getting handed on to Other people. It’s also truly worth noting that everyday living coverage will let you leave a legacy. Should you have charitable pursuits, As an example, you can use lifetime insurance policies to fund a charity or bring about that’s essential to you.

As you think about lifetime insurance policies, you could have listened to about the significance of receiving protection if you're young and nutritious. That’s for the reason that premiums are generally reduced the sooner you purchase daily life insurance. The more mature you have, the higher the rates become, especially if you have health and fitness conditions. By locking in the coverage if you're in superior well being, you are able to protected additional affordable protection for the long run.

A person component That usually confuses individuals could be the query of whether or not lifetime insurance plan premiums can transform as time passes. With phrase everyday living insurance policies, the rates frequently remain preset for that length in the time period. Nonetheless, with entire lifestyle coverage, the premiums are usually amount but may well raise somewhat after a while to maintain up with inflation. It is necessary to know how your premiums will behave right before committing to a plan.

Existence insurance policy is also a terrific Software for estate preparing. Should you have considerable belongings or investments, lifestyle insurance policies might help your beneficiaries include any estate taxes, so they don’t need to market off belongings in order to shell out People taxes. This Get it here makes certain that your legacy continues to be intact for foreseeable future generations. This may be significantly essential for all those with firms or high-benefit properties.

When searching for existence coverage, it’s essential to shop around and compare unique guidelines. Every insurer delivers distinctive conditions, protection alternatives, and rates. With a little investigation, yow will discover a plan that most accurately fits your needs and spending budget. Furthermore, on the internet applications and daily life insurance plan calculators can assist you get an estimate of the coverage you may need, which often can make the method easier.

Even so, before you decide to dive into buying a plan, it’s vital that you totally have an understanding of the stipulations. Pay attention to exclusions, like suicide clauses or procedures that don’t address certain types of Loss of life. Also, you should definitely’re mindful of any waiting around durations or conditions hooked up to your policy. By extensively looking through the good print, you can prevent surprises afterwards.

Not known Facts About Insurance Financial Solutions

A important Section of lifetime insurance plan is choosing your beneficiaries. These are definitely the persons or businesses that should get the payout if you pass away. It’s important to maintain your beneficiary designations current, particularly when your lifetime conditions alter, such as marriage, divorce, or the delivery of a child. It’s a smart idea to periodically critique your beneficiaries to make sure that they reflect your latest wishes.Getting My Home Insurance Solutions To Work

Top Guidelines Of Professional Insurance Solutions

Existence insurance plan may also assist you to in retirement arranging. Some guidelines, notably total life insurance coverage, give a dollars benefit ingredient. This hard cash benefit grows over time and will be accessed by financial loans or withdrawals, which can offer a source of cash flow all through retirement. Although this isn’t a substitute for a standard retirement program, it may possibly nutritional supplement other savings and investments.

The Best Strategy To Use For Complete Insurance Solutions

One more benefit of daily life insurance plan is the opportunity to deliver for final expenses. Insurance Solutions for Healthcare Providers Funerals is often costly, often costing Many dollars. With no everyday living insurance policy, your family can be forced to bear the financial burden of one's funeral expenditures. A lifestyle insurance coverage policy can protect these bills, enabling your family members to concentrate on grieving and celebrating your life, rather then stressing in excess of monetary issues.

You might be wanting to know, “Is lifetime insurance plan really necessary if I’m in great overall health and also have no dependents?” The reality is, it’s however a good suggestion. Incidents and sudden health problems can occur at any time. Having lifestyle insurance policy makes certain that Your loved ones received’t be remaining with money burdens, irrespective of your existing circumstance. Plus, it may possibly offer you peace of mind knowing that you just’ve prepared for the unforeseen.

Lifetime coverage isn’t nearly providing a monetary protection net; it’s also about taking responsibility for your family members’ potential. By possessing a daily life coverage coverage set up, you happen to be making certain that Your loved ones can keep their quality of life if one thing have been to happen to you personally. It is an investment decision inside their future, permitting them to continue their lives with no fat of monetary hardship.

After you’re thinking about daily life insurance plan, It can be essential to keep your extensive-time period fiscal plans in your mind. Everyday Visit the site living insurance coverage could be a aspect of a bigger money system, Functioning along with your retirement personal savings, investments, along with other belongings. By integrating daily life insurance policy into your broader monetary approach, it is possible to make a safer and steady foreseeable future for you and your spouse and children.

In the end, life insurance policy is a lot more than just a policy—it’s a guarantee. It’s a promise that All your family members is going to be cared for, even when you're no longer all-around. No matter if you happen to be just starting out in everyday life, preparing for retirement, or securing your legacy, lifestyle insurance can offer the assist and assurance that you and your family and friends have earned. So, take some time To guage your options, check with a trustworthy advisor, and find a policy that actually works to suit your needs. Your long term self (and Your loved ones) will thanks.

Mara Wilson Then & Now!

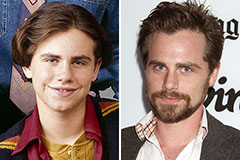

Mara Wilson Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Batista Then & Now!

Batista Then & Now!