In relation to arranging for the longer term, life insurance plan alternatives are often the first thing persons take into consideration. They provide a sense of safety and peace of mind, realizing that the loved ones are going to be fiscally guarded in case the sudden takes place. But existence coverage could be a difficult strategy to grasp, particularly when you are bombarded with so a number of procedures and terms. So, how Are you aware which life insurance Option is good for you?

Permit’s split it down. Existence insurance policy is available in a lot of types, Every meant to meet up with distinct requirements and economic goals. No matter if you’re in search of some thing very simple and affordable, or a more thorough policy that builds cash benefit with time, there’s a everyday living insurance policies Answer tailor-made only for you. But before we dive in to the specifics, it’s crucial to comprehend the goal of life insurance policy. It’s not only a monetary protection net; it’s a method to make certain All your family members can proceed to thrive, even when you're now not close to.

Insurance Solutions For Businesses for Dummies

The first step in exploring everyday living insurance policy answers is to understand the different types of coverage out there. The 2 main classes are time period existence insurance policies and long lasting daily life insurance. Expression lifestyle insurance coverage supplies coverage for a particular stretch of time, typically ten, 20, or thirty years. It’s typically a lot more cost-effective than everlasting existence insurance coverage, making it a well known option for youthful people or people on a spending budget. Nonetheless, after the term expires, the coverage ends, which means it’s not a choice If you'd like lifelong security.

The first step in exploring everyday living insurance policy answers is to understand the different types of coverage out there. The 2 main classes are time period existence insurance policies and long lasting daily life insurance. Expression lifestyle insurance coverage supplies coverage for a particular stretch of time, typically ten, 20, or thirty years. It’s typically a lot more cost-effective than everlasting existence insurance coverage, making it a well known option for youthful people or people on a spending budget. Nonetheless, after the term expires, the coverage ends, which means it’s not a choice If you'd like lifelong security.Alternatively, long-lasting lifetime insurance policy answers past your overall life span, provided that premiums are paid. Within just permanent lifestyle insurance policies, there are distinctive variants, like full daily life, common lifetime, and variable lifestyle insurance coverage. Every single of such has its exclusive attributes, for instance cash price accumulation, versatile premiums, and financial investment selections. Full existence insurance policies, by way of example, offers a set high quality as well as a certain death advantage, supplying both equally defense along with a discounts component that grows eventually.

Now, let's talk about the significance of getting the right life insurance Resolution for your individual situation. When selecting a coverage, it’s very important to take into account your monetary plans, spouse and children composition, and long term requires. Do you need your beneficiaries to get a large payout, or would you favor a plan that may serve as a economical asset in the future? The answer to those thoughts will help manual you toward the best plan. It’s also very important to evaluate your price range—some policies are more inexpensive than Other people, and you’ll wish to make sure the quality fits comfortably in your economic plan.

Among the most valuable facets of life coverage remedies is their capacity to provide money security for the family members. If a thing ended up to occur to you, your coverage would spend out a Dying profit which can help deal with funeral prices, excellent debts, and living costs. But everyday living insurance coverage might also serve other purposes outside of protecting Your loved ones’s economic long term. As an example, some existence insurance options present living benefits, which let you access your policy’s dollars benefit while you're still alive in the event of a terminal ailment or other emergencies.

One more factor to look at when choosing a everyday living insurance Remedy is your age and overall health. The younger and much healthier that you are when you buy a policy, the lower your rates are prone to be. In case you wait around right up until you happen to be more mature or struggling with health issues, your premiums can be substantially bigger, or you might be denied protection altogether. That is why it’s vital that you program in advance and explore your options When you're in superior wellness.

Everyday living insurance policy can also Enjoy a significant position in estate planning. When you have property you want to go on in your beneficiaries, a life coverage policy can help deliver the required liquidity to go over estate taxes, guaranteeing that your loved ones aren’t burdened with a substantial tax bill When you move away. By strategically incorporating existence insurance into your estate approach, you can produce a extra successful and value-effective strategy to transfer prosperity.

Allow’s also discuss the flexibleness of everyday living insurance policies methods. In nowadays’s environment, our wants are consistently shifting. That’s why some lasting existence insurance policies policies, like universal existence, present flexibility when it comes to premiums and Dying Rewards. With common lifetime insurance policy, it is possible to change your coverage as your situations evolve, which makes it a wonderful option for individuals whose fiscal problem might fluctuate after a while. This flexibility is very practical for those who want to be certain their coverage stays in line with their requirements.

Will you be somebody who likes to take an active part in controlling your investments? If that's so, variable lifestyle insurance policies might be the right choice for you. With variable life insurance policy, you are able to allocate a percentage of your premiums into a number of expense alternatives, such as shares, bonds, or mutual resources. This can provide the possible for increased cash benefit accumulation, but In addition it comes with much more chance. So, if you’re snug with the idea of sector fluctuations and want to be much more involved in your plan’s growth, variable life insurance policies can be a fantastic in shape.

Of course, no daily life insurance coverage solution is without having its negatives. Time period existence insurance, Access here though reasonably priced, doesn’t supply any dollars value or investment potential. After the expression finishes, you might require to get a different plan, generally at the next amount. Permanent existence insurance policies solutions, Then again, is often costlier and might not be essential for Anyone. It’s essential to weigh the advantages and drawbacks of each solution before making a call.

When looking for daily life insurance coverage, it’s also essential to evaluate the name and economic balance on the insurance company. You would like to make sure that the company you select is financially powerful and it has a track record of paying claims promptly. In spite of everything, The full stage of everyday living coverage is to offer comfort, so that you’ll want to choose a provider you'll be able to rely on to deliver on their own promises.

Some Known Incorrect Statements About Insurance Customer Support Solutions

While lifetime coverage is an essential Component of Lots of individuals’s financial planning, it’s not the only Answer. There are actually other strategies to guard your family and Create prosperity, for View more instance investing in retirement accounts, savings designs, and other sorts of insurance policies. Lifetime coverage must be witnessed as 1 bit of a broader economic tactic that helps you obtain your extensive-time period plans and guard your loved ones.But Permit’s not forget about the emotional benefits of life coverage. Being aware of that your family are going to be taken care of fiscally can bring comfort, especially if you’re the key breadwinner. Everyday living insurance policies offers a safety net, ensuring that your loved ones don’t really have to battle monetarily after your passing. It’s a present that keeps on providing, long after you’re long gone.

The Ultimate Guide To Insurance Consultancy

It’s also really worth noting that daily life coverage answers might be a useful tool for entrepreneurs. For those who possess a company and want to make sure its continuity just after your Loss of life, life insurance plan can provide the mandatory resources to get out your share in the small business or to protect any economical obligations. In some instances, lifetime insurance coverage may even be applied being a funding resource for just a acquire-sell settlement, supporting to protect your business associates and safe the way forward for your business.

In case you’re Not sure about where by to begin In regards to choosing a life insurance plan solution, contemplate dealing with a money advisor or insurance policy agent. They may help you navigate the various possibilities offered and ensure you’re generating an educated final decision based upon your exceptional condition. A specialist may also assist you realize the good print of each plan, this means you’re crystal clear on what’s bundled and what’s not.

In conclusion, Visit now daily life insurance coverage methods are A vital element of the stable money prepare. No matter if you end up picking term daily life or lasting daily life insurance policy, the target is the same: to guard your family members and supply economical protection if they will need it most. By knowing your choices and selecting the appropriate coverage for your preferences, you may ensure that Your loved ones is effectively looked after, no matter what the longer term retains. So, make an effort to investigate your options and look for a lifestyle insurance policies Remedy that actually works for yourself. Your loved ones will thank you for it.

Christina Ricci Then & Now!

Christina Ricci Then & Now! Danielle Fishel Then & Now!

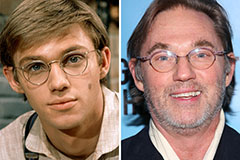

Danielle Fishel Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!